Not known Factual Statements About Opening Offshore Bank Account

On the various other hand, specific worldwide financial institutions will certainly decline to do business with specific foreign customers due to conformity needs. Banks are needed by the (OECD) as well as the World Profession Company (WTO) to report details about their international clients.

According to numerous, having offshore bank accounts is thought about an exotic tool for personal privacy as well as tax evasion, as well as it is just offered to the very affluent. On the other hand, an overseas savings account can be a valuable instrument for property protection preparation for individuals that have also modest quantities of cash.

They are a beneficial tool for individuals that routinely receive and send out overseas repayments and those that make a large number of worldwide deals (opening offshore bank account). Right here's a review of some of the functions as well as reasons you would certainly intend to open up an overseas account: US Citizens' Offshore Savings Account in a Particular Nation One of the negative aspects of the net is the spread of disinformation.

While specific points have actually modified throughout time, the truth remains that United States locals are permitted to produce accounts outside of the nation. An offshore financial institution account is any type of monetary account in a country various other than the one in which you are a resident.

Some Of Opening Offshore Bank Account

Banks will certainly require to confirm the credibility of any of your papers. In some instances, a notarized copy of certain papers might be adequate. On the other hand, other overseas centers choose an apostilles stamp, a qualification mark made use of internationally. If this is the situation, you will certainly need to visit the government official licensed to release this stamp for your state or nation.

Offshore Accounts for United States Citizens as well as Its Constraints These nations are available for US residents if they want to open an offshore bank account: What are the Restrictions? When the (FATCA) was wrapped up as part of the HIRE Act, several financial professionals declared that the new Act's single purpose was to prevent people from opening up offshore accounts.

FATCA did require individuals to file papers that confirm the presence of their accounts and, in some instances, make a note of any rate of interest earned. Take into consideration that the collective equilibrium does not need to continue to be above $10,000 for an extended duration. Users must submit the report if this happens on a single day throughout the tax year.

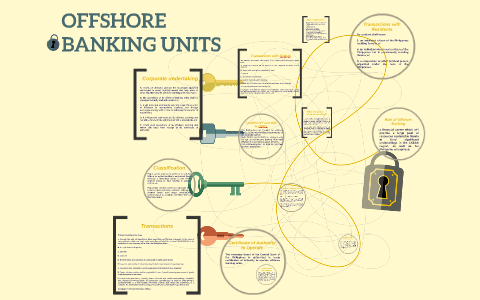

Money maintained in financial institutions past the jurisdiction that generates the money is called eurocurrency. Local financial companies and also public authorities have no influence over the actions of overseas systems. It is crucial to recognize that these entities can not get funds or deal fundings to citizens of the nation in which they are presently stationed.

Opening Offshore Bank Account for Beginners

Several businessmen might ponder keeping the financial resources to OBUs to avoid paying taxes and/or to maintain their money private. Various other assistance programs on deals like offshore financing are rarely offered.

On the other hand, offshore banking has had a dreadful rap in the previous few years, many thanks to the affluent and renowned dragging it via the dust with various tax evasion schemes. Offshore accounts, in addition to overseas banking as a business, really aren't unlawful. Numerous international executives as well as migrants, in fact, open overseas accounts once they migrate overseas because they allow sources from anywhere in the world.

Advantages of Licensed Offshore Banks To avoid the unfavorable repercussions of storing money at a bank in your house country, you or your company can use offshore accounts. You are making use of an overseas financial institution in a transparent, extremely regulated nation. It is harder for authorities to confiscate possessions held in overseas savings account.

You can safeguard your properties from hazards like these by a licensed overseas bank. The privacy that includes having your accounts held outside your own nation is one of the advantages. In some countries, such as Switzerland as well as Singapore, bank privacy is a lawful right, and also banks are banned from disclosing details concerning their account owners or assets other than in remarkable scenarios, such as a criminal investigation.

Opening Offshore Bank Account - Truths

As a migrant, this eliminates the requirement to recover taxes currently paid as well as the aggravation of integrating your tax obligation returns to ensure you are not paying too much tax obligation. Having an overseas savings account can be beneficial when it involves estate planning. The ability to save and spend funds in an international money for international deals could be useful for persons who run worldwide.

Offshore Savings Account Perks and Advantages Offshore accounts make taking care of economic responsibilities in several countries as well as areas more accessible. If you require to send or receive normal overseas repayments and also transfers, they can be valuable. Every overseas checking account has its own collection of attributes and advantages; right here are a few of one of the most usual: Offshore Financial Disadvantages Regardless of the several benefits as well as benefits that offshore checking account can provide, there are still disadvantages.

go to my blog official site Source